Publication

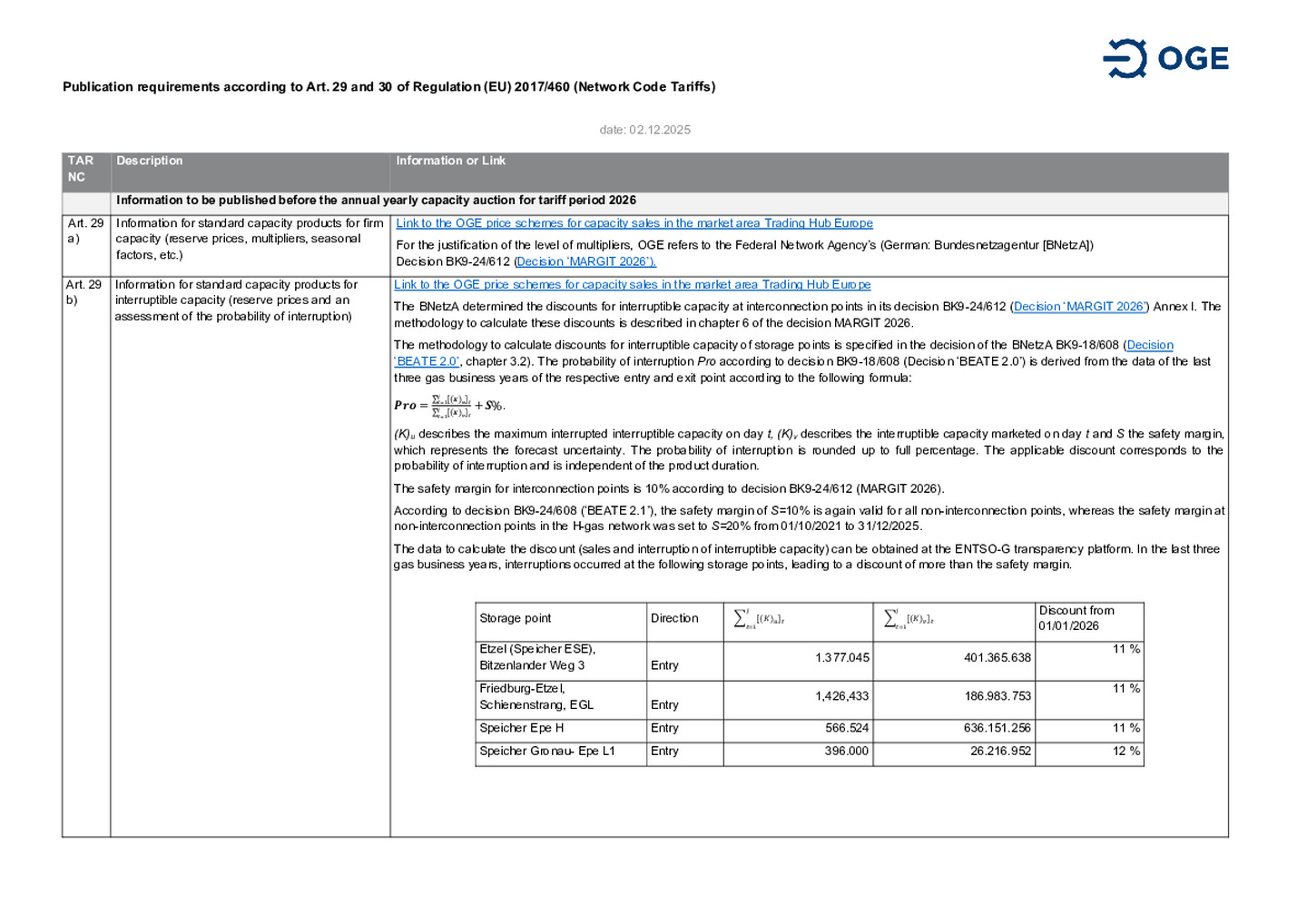

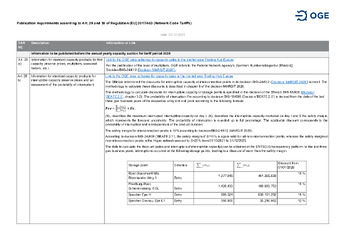

Information to be published before the annual yearly capacity auction and the tariff period

Publication by Open Grid Europe GmbH according to the network code on harmonised transmission tariff structures (Regulation (EU) 2017/460)

Here you can download all current publications. We are happy to answer any questions you may have.

Downloads

Publication prior to the yearly capacity auction and the tariff period

Decision ‘MARGIT 2025‘ and

‘MARGIT 2026‘

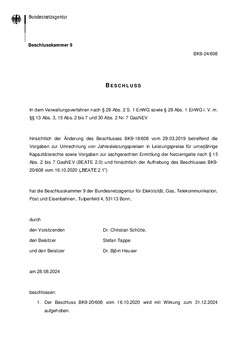

Decision ‘BEATE‘

REGENT Rulings